An analysis of Wildland’s “Proof of Usage” Model

This research was commissioned by the Wildland team and funded by a Golem Foundation grant. It was written in Q2 2022. Please check that information is accurate or up-to-date at the time of reading.

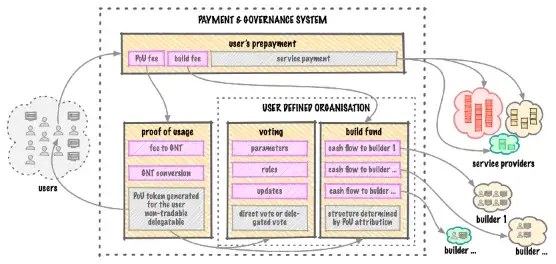

This blog forms Part 2 of 2, analyzing the concepts of “User Defined Organization” and “Proof-of-Usage” as proposed by Wildland. We recommend reading Part 1 on these concepts.

PART 2: Introduction

This piece analyses Wildland’s proposed “Proof-of-Usage” mechanism (see Part 1 to learn more about Wildland and “User Defined Organizations”) through the lens of institutional constraints on public finance that have emerged in modern democratic constitutional ordering. Constraining and balancing government authority is the essence of more representative collective action organizations. One of the most fundamental questions in constitutionally constraining the act of organizing (or collective organization) surrounds the power of the public purse — or spending public money. This is an especially salient concern in the decentralized blockchain networks whose governance involves coordinating the expenditure of collective funds for a public purpose.

Constitutional public finance is thus a field of central relevance for token design surrounding governance rights and spending of an ecosystem building fund (such as the Wildland Build Fund UDO). The existence of a build fund separate from the fiscal contributions of those engaging in governance exacerbates more general public finance problems, which creates the need to define public purposes for community funds, and processes for the allocation and assessment of these funds. This post explores institutional design principles surrounding the challenge of constitutional public finance in the specific context of the Wildland Build Fund, but given the inescapability of the question of public finance in decentralized collective organizations, it is likely that these principles are more broadly applicable as a pattern of governance principles for other projects.

Top 10 line takeaways:

1. Constraining disparities of power between stakeholders in governance processes is essential to the resilience of decentralized (democratic or highly participatory) organizations.

2. Disparities in governance influence often result in controversial or divisive governance — in terms of the extent to which members consider these outcomes are “legitimate” given the organization’s purpose — this makes a clearly defined purpose for governance an essential precondition to resilient collective action organizations that balance diverse member preferences.

3. One long-standing solution to the challenge of constraining disparate governance influence involves conditioning access to a group’s productive resources on proximal usage of those resources.

4. Separating speculative interests from users (those who use the network, as distinct from those who engage or participate in network production and/or the processes of governance) who directly value the productive capacity of scarce resources is critical in many economic and financial contexts.

5. Locking financial influence out of economic organizations is detrimental to productive efficiency, though, which means balancing direct resource usage with the organizational need for capital is a common tradeoff.

6. In digital currency contexts, usage of a network is integrally financial and permissionless in ways that make the presence of speculative interest more likely.

7. Contexts, where the use of an organization’s output is non-transferrable, is one way to try to limit speculative interests, which makes governance tied to usage (output consumption) desirable in certain contexts.

8. The newfound ability for users of an organization’s output to govern that output (and ensuing surplus from improvements to production processes) presents several advantages surrounding local knowledge, cost savings, and intrinsic user valuation of distributed governance.

9. This same distributed ability to disburse collective surplus (or seed money) presents a problematic set of margins that are heightened when individuals can buy governance influence through apparent “usage”.

10. This means governance by users in these contexts directly poses the quintessential problem of the capture of public finance by special interests (relative to legitimate stakeholder groups as defined by the organization’s animating purpose), which poses a critical need for constraints on the allocation of surplus funds to prevent this essential problem.

Constraining Disparate Influence in Governance through Defining Organizational Purpose

Constraining disparate levels of influence in political systems is a long-standing problem in collective choice. Some measures of constraints on government action are thought to provide ex-post guardrails around the scope of citizen activity subject to the collective decisions of the government. Ex-ante limitations surround how each citizen is entitled to vote and cannot sell their vote to third parties — this limits any one individual or organization’s ability to dominate processes to achieve their desired outcome, as opposed to one that reflects the common good (as defined by the organization’s formally constituted purpose, or as created through the revealed aggregate of individual members’ pursuit of their goals through the organization). Even from a narrower view of political processes as a circumscribed sphere of contestation that delimits more destructive conflict elsewhere (Tilly 2002), the ability to have a chance to contest successfully is a precondition to individual participation in such a sphere. Otherwise, more subversive methods of conflict tend to predominate, including the observed endpoint of outright guerilla warfare (for but one example of subversion of governance leading to resistance by subterfuge, the recent Sushiswap scandal is illustrative). Thus, sufficiently balancing disparities in power within a given system is seen as a precondition to legitimate governance, which itself facilitates more productive governance than systems that lack legitimacy and operate through fear and political clientelism (Ferejohn 2009).

Legitimacy can be understood to partly derive from individual organization members’ (or network users’) belief that the governance of the system will not impinge on their interests beyond a level contemplated in previously defined constitutional restrictions (Rosenfeld 2001). In private organizational contexts, sufficient constraints on outsized influence may be a necessary expectation on the part of those considering whether to join an organization or participate in producing its output. Absent sufficiently well-advertised constraints on the ability of more powerful actors in the system to game outcomes, less powerful users may never engage in the system’s processes due to this rational game theoretic concern (Wallis 2015).

If in the context of Wildland, someone’s data demands surrounding storage or analysis (as proxied for by expenditure in the Wildland Marketplace) pale in comparison to those of other marketplace purchasers, they will rationally not participate in governance processes that their tokens entitle them to, due to these tokens’ low likelihood of determining governance outcomes. This concern can be understood as the reason for quadratic voting as envisioned in the Wildland model, although too strong of a quadratic voting rule, and the concern can flip in terms of higher powered users having rents extracted from them for changes to occur, due to the comparative strength a proportionally diluted voting rule accords smaller interests. An exhaustive review of voting rules (and their respective strengths and weaknesses) would be the subject of a political science textbook alone, and as such is beyond the scope of our analysis here, although the innovation in voting rules within distributed network organizations has resulted in considerable applied discussions of these types of tradeoffs (Daub 2022).

Throughout this analysis, the purpose of an organization is discussed as if it is well defined, generally known, and broadly agreed upon. In complex organizations, none of these characteristics of a “purpose” can be taken for granted. This is because an organization’s animating purpose, in constituting the organization itself, defines the future institutional margins that different stakeholders’ divergent preferences and interests then vie within (Alston et al 2021).

An organization’s constitutive purpose subsequently provides a means of assessing what is good faith action within the collective choice set of an organization. Absent clearly defined constraints on the expenditure of public funds, administrators can treat themselves to fancy dinners and contract with their friends and family members using the public purse, all arguably in furtherance of a poorly constrained “public purpose”. This makes a clearly articulated purpose of an organization, and constraints on the collective choice process intended to further that purpose, essential to aligning interests among diverse stakeholders within a given organization. Thus, references to purpose throughout can be taken to repeatedly emphasize the importance of this component of organizational design, as opposed to assuming that a well-defined and constrained purpose animating collective action emerges automatically.

Usage as Validating Individual Intent as Consistent with Intended Purpose

In the context of governing natural resource development on historical frontiers, this concern over constraining the input of the powerful resulted in legal doctrines surrounding proof of usage of a given natural resource in productive economic activities. Observable usage of productive resources thus has a long history as a means of displaying intent to contribute to a particular community’s development. In the case of land rights in the US West, free land was available to individuals willing to make improvements to the land for a period of five years (Hibbard 1924; Gates 1968). The government was foregoing revenue from land sales to induce development more quickly than would have otherwise occurred. In the case of water in the arid US West, applying the water to a beneficial use was a step precedent to securing rights to that water against later claimants (users) of water (Smith 2021). For rights to valuable subsurface minerals, active development of those minerals was necessary to secure those rights against adverse claimants (Gerard 2001).

This preference for use in securing valuable rights to the inputs to economic activity in the US has also been labeled the anti-speculation doctrine (Neuman 1998 at 962–966), an eponymous reference to the deliberate governance choice of removing the ability to obtain productive assets simply to speculate on their future value. Given the animating governance purpose of inducing western development, speculation was reduced by limiting the ability of non-users of the resources to secure rights to them. This led to many challenges associated with defining and measuring the beneficial use of these resources (Clark and Joseph 2005). This is because identifying the volume of water drawn from a stream, and acceptable beneficial uses to which that water could be put is a far cry from the immediate recordation and traceability of usage of digital networks (including purchases of data storage on a decentralized marketplace). Standardized units, and the information underlying them, are the lifeblood of modern impersonal exchange of abstract financial instruments. Distributed networks also require an action space surrounding the exchange of units of account that does not suffer from uncertainty as to where units are expended — this makes measurement of network usage mechanical, but defining the action space to where this usage corresponds to the protocol designer’s intent is far harder. The challenges of constraining marketplace usage to correspond to true intent to use the system’s storage services are thus one example of this quintessential governance of collective action at an impersonal scale.

Speculation and monopolization were thus early reasons for the development of legal requirements tied to the actual use of a given resource to obtain property rights to it. In the resource-rich US west, the overriding concern animating these doctrines tied to productive use was one of disparity in access to capital. The concern surrounded the ability of well-capitalized interests in the eastern United States to obtain scarce resources that were necessary for economic activity in the West Rather than putting these resources to uses that would benefit local communities economically, and local governments fiscally, the concern was that speculative interests would hold these resources unused for extended periods, effectively depriving communities of the margins of growth subject to speculation. If ownership was not tightly linked to the productive use of the resources, this would have created a possibility for external interests to monopolize an essential input to local economic activity, placing such interests in a position to capture some or all the rents associated with production (Gates 1971). If all local farmers had to buy water from a single owner in a particular region, this would result in that water monopolist extracting many of the rents of production from those more directly engaged in the productive activity.

Whether or not the anti-speculation doctrine achieved these aims is beyond the scope of this analysis, but what warrants emphasis surrounds the divergence in intent for the given community — speculators’ incentives were thought to be misaligned with those of long-run productive outcomes tied to local economic activity (Billington 1945). If contemporaneous economic development can be understood as the emergent purpose of individual settlers’ frontier activity, the ability of external interests to “game” this intended outcome for public resources was sufficiently problematic that requirements for actual use of resources became a legal predicate to ownership of those resources. Usage as a means of validating one’s intentions within a particular community is therefore an age-old institutional solution in filtering for intent. This can be understood as a corollary to the economic notion of revealed preference, which holds that observing individuals’ actions can be more revelatory of their inner preferences than asking individuals about those same inner preferences. Put most simply, actions speak louder than words, and so usage may speak more loudly than financial ability to command tradable shares in governance outcomes.

Importantly, in the context of the US West, productive usage substituted for finance in cases of disparities, whether external or internal in incentives tied to distinct financial positions. Whether a speculator was located in the east, or local to a particular frontier community, the ability to purchase large amounts of resources stood at odds with the intent underlying the disposition of public lands through settlement by impoverished immigrants in the East. Nonetheless, the purchase of public lands was still an option for well-capitalized individuals, both because the government following the Civil War was revenue-hungry, and the desire to develop western lands cut against locking out capitalized interests altogether. This displays an essential tradeoff in collective governance of shared resources — capital is an integral input to development at an efficient economic scale, but capital’s very nature creates the possibility for it to over-determine outcomes of collective decisions relative to an organization’s intended purpose(s) (Fauver and Fuerst 2006). This makes outright prohibitions on the influence of capital in production contexts much rarer than limitations as to the extent and form of influence that capital can have, as compared to other individuals engaged in production. In digital governance contexts surrounding the independent exchange of coordinated units of account, locking out capital is effectively impossible, which makes striking the right balance between disparities in capitalization among potential user classes, particularly critical.

Restricting Financial Activity to Usage by Limiting Secondary Trading

In many digital currency contexts, use is essentially financial — this structural characteristic is inextricable from the choice of the medium. For example, Proof-of-Usage, as designed in Wildland, measures currency spent in the Wildland marketplace. In one sense, financial use cleanly maps to the distinctions developed thus far — those who choose to park economic value in the use of a given network’s services have directly displayed an interest in engaging in the productive output of that network. Investment in financial assets can proceed for reasons of belief in the real productive capacity of the organization seeking finance through issuance of debt and equity instruments, but can just as often occur due to speculation in the form of betting on the future sale price of the financial instrument to other investors, separate from the real productive value of the asset at the point of purchase and sale (Angel and McCabe 2009). An increase in speculative activity can lead to price volatility as well as reductions in investor discipline of specific asset classes (Hirano and Stiglitz 2022) — if the investment is less well tethered to specific decisions made by the organization in pursuit of its output, this suggests both a weakening of prices as signaling productive capacity as well as disciplining the organization’s decisions. For non-economist readers, this is important because prices are information as to what is valuable and scarce — if knowledge of what is scarce and valuable is distorted, resources can’t be allocated efficiently — creating waste and lowering productive output (value creation). The digital currency industry currently has a high level of speculative investment interest, which is borne out in high price co-movement and volatility.

A means around the problem of speculation versus a financial bet on the real value of an ecosystem (as a function of the articulated purpose) is that of preventing secondary trading in the asset being acquired. While value is ultimately subjective in the eyes of the individual network user, absent price signals (and their associated downsides), preventing secondary exchange verifies subjective value through defining usage as a means of validating good faith intentions. The simplest form this can take is the exchange of value for a service that cannot be exchanged past the primary sale. To take a trivial example, a hamburger acquired at a restaurant cannot be a source of speculative financial activity, but this point applies more generally to any digital services where economic value is exchanged for the service such as storage of data or processing power allocated to a specific task. Such a context benefits from squarely aligning purchasers’ interest in the service with the actual use of the service, as opposed to speculation as to the future value of access to the service. This can be understood as a version of the beneficial use standard described previously as intended to limit speculative investment incentives in western natural resources.

Governance’s value to its stakeholders derives facially from that which the system governs — in the case of Wildland, governance entails the allocation of a community fund for ecosystem growth purposes. It is important to note that this institutional mechanism cannot fully prevent the exchange of financial value for influence in a given system (through side payments that are quite possible and hard to detect in digital currency contexts). Moreover, locking out financial influence in favor of more democratic user input creates its own set of downsides associated with a diminution of price signals and the enhanced possibility for political gridlock.

This class of restriction on speculative interest in claims against future output is largely limited to cases where the output’s primary value surrounds consumption or use by the acquirer. In financial terms, this makes these claims more like commodities than equities, although most commodities freely trade on secondary markets. Restricting assets’ secondary trading drastically reduces their value, limiting it to the use value consuming or holding the claim involves for the primary purchaser — for example, real estate markets’ capitalization would be drastically reduced if people could never exit their property once acquired. This suggests that limiting secondary trading in a valuable output is often less of a design choice, and instead a direct function of the organization’s output itself.

In cases where the output is indeed one that limits secondary trading in that claim to the organization’s output or common funds (such as the hamburger reference previously), this has the effect of aligning users’ incentives with that of genuine use as opposed to speculation. If users cannot engage in governance directly, this fully limits users’ input into governance at their point of the choice of whether to purchase the services (and become a user) or not. If a purchase can be made for use by third parties, this design feature alone can split governance incentives from usage, which provides one example of the general challenge of conditioning proof of usage on marketplace activity.

Proof-of-Usage’s Governance Opportunities and Public Finance Challenges

Despite the benefits of aligning the use of an organization’s output to governance, consumer choice of whether to exchange economic value for the service is limited on important margins. For much of modern economic history, this has been the primary input that atomistic consumers have into the governance of large commercial producers of goods or services from which these consumers choose (Schuler and Christman 2015). This can be understood as the canonical political choice of voting with one’s feet. In the wake of the digital transformation of many classes of economic activity, and the innovations that blockchain networks entail, transparency and decentralized input into governance processes are possible in ways previously unfeasible due to existing limitations on collective action surrounding information, agency, and coordination costs (Davidson et al 2018; Alston et al 2021). This poses a fascinating possibility for people using a good or service to directly govern the production of that good or service in future periods.

Through the display of well-aligned intentions for the ongoing viability of the organization’s output through the usage of that same output, users can potentially be stewards of that same output. This suggests several benefits to this form of input into governance. First, this can harness local knowledge at the consumer level of services in ways that traditionally centralized firm governance necessarily struggles to replicate. Second, in contexts where users care about governance outcomes, this may provide an efficiency gain over the costly bureaucratic apparatus that more centralized governance necessarily carries with it (Coase 1937). Third, to the extent more egalitarian input into organizational output is something users intrinsically value, this can be a source of competitive advantage, in addition to the efficiency benefits that this form of governance can offer. Finally, and perhaps most crucially, where this governance results in efficiency gains that create a surplus for the organization itself, these gains can be directed by users in future periods to projects or outputs that further enhance the ecosystem (Wright 2020).

In contexts of distributed networks in their early phases, these community funds dedicated to ecosystem growth can involve code improvements, changes, or applications that spur greater usage of the network, among many others. In Wildland’s case, these projects will be greatly defined by the marketplace storage purchasers who are empowered to engage in governance — defining what enhances the ecosystem is the process of governance itself. This final possibility involves the allocation of valuable resources to subclasses of members of a given organization (or external parties contracted to provide ecosystem improvements). This creates an important margin that defines “users” of the organization’s output incentives in both beneficial and problematic ways. The existence of a surplus (or a startup seed fund to spur ecosystem development) directly encourages participation in governance by users, above and beyond their intrinsic tendency to do so. The existence of surplus funds to improve the ecosystem creates an incentive for users to engage in the personally costly process of governance due to potential improvements in their usage this will create.

The problematic incentives lurk in the space between cost of usage and the size of funds to allocate for ecosystem improvement. The lower the cost of usage mapping to governance power, and the larger the surplus funds that governance decisions allocate, the greater the incentive for “dishonest” users to engage in governance processes for selfish reasons (at odds with the organization’s purpose) as opposed to faithful intent to improve the ecosystem for all users. This can be understood as a specific example of the classic special interest group problem within constitutional democracies (Olson 2008; Buchanan & Tullock 1962). The number of users engaged in governance, and the comparative levels of use (as mapped to governance power) both create problematic margins for “dishonest” users. In the case of Wildland’s model, these “dishonest” users are potentially those whose marketplace activity is predominantly or exclusively derivative of the ability to allocate surplus organization revenues (or a pot of seed money) to themselves or projects they care about for reasons unrelated to improving organization outputs. If purchasing the organization’s output at a level sufficient to control governance outcomes is cheaper than the benefits associated with the allocation of the organization’s surplus, then usage will no longer align incentives productively, for “honest” users (or storage purchasers) of the Wildland Marketplace will likely be dwarfed by a class of users who are primarily or exclusively motivated by political economic gain, at the cost of benefits to the ecosystem that organizational surplus is intended to create. This makes defining the allocation of a set of resources common to the organization a central institutional design question for financial-usage defined governance processes — absent secondary trading in governance tokens, users’ governance incentives will be fully defined by the individual and group benefits associated with the allocation of these common resources.

This governance design challenge is canonical. In democratic public governance contexts, this is the hallmark question of constitutional public finance subject to capture by special interests (Gruber 2019; Cullis and Jones 2009). This is often characterized as “concentrated benefits, dispersed costs”, which summarizes why smaller special interests have unique advantages when it comes to influencing the disbursement of public funds (or other outputs of government that discrete groups in society care about). The incentives created by the system of governance define individual members’ incentives, which then greatly determine outcomes in practice.

This challenge surrounding the allocation of the surplus of the organization’s activity directly creates two classes of users of an organization’s output — those whose intent is well-aligned with better achieving the intended purpose of the organization, and those whose intent is orthogonal to that organization’s purpose. Incentivizing good faith participation in the processes of governance by the class of users who truly care about the ongoing improvement of the ecosystem (the clear ex-ante definition of which is crucial!), while simultaneously diminishing the ability of special interests to capture surplus is a challenge that no public government has fully overcome. The ongoing contentiousness of public budgeting processes in the world’s most capable governments is a direct testament to this reality.

While detailing how public finance is constrained is outside the scope of this analysis, it is worth mentioning that these constraints are likely essential to aligning users’ incentives to be productive stewards of organizational surplus, as opposed to siphoning those funds away for purposes unrelated to ecosystem improvement. In contexts where expenditure is commensurate with usage, these constraints on public finance become even more important: at the point of sale of the network’s services, there is no effective way to differentiate between those who intend to use the service they have purchased and those whose usage is derivative of the desire to capture rents allocated through the processes of governance themselves.

Conclusion

A clearly defined purpose animating collective action, and well-constrained collective choice processes in furtherance of this animating purpose are essential and entangled components of resilient collective choice organizations. Distributed networks are no different in this hallmark institutional design challenge (Nabben 2022). Therefore, any distributed network like Wildland will confront its specific version of this challenge in creating a system governed by Proof-of-Usage. This is a hard problem to solve if incentives are aligned both initially and dynamically, and fatally irresolvable in cases where incentives among potential users are sufficiently misaligned. The initial definition of the system’s purpose is central to this challenge, which in the case of the Wildland Marketplace means clearly defining the ecosystem and the growth that Build Funds are meant to generate. This necessarily involves clarifying goals for the ecosystem beyond just growth, and ideally would involve defining success in the short to medium term, providing a benchmark against which different stakeholders could evaluate progress. This is especially the case when the expenditure of scarce community resources is on projects that are likely to provide varying levels of growth, even in cases where governance participants and recipients of these community funds are acting in good faith.

The inevitability of a constitutional political economy as sketched throughout means that governance design necessitates a clear mapping of stakeholders and incentives created by the animating purpose and constraints on collective action. Only given sufficient clarity as to these essential institutional features, can potential users of a network understand that incentives are well-aligned to the point they want to become contributing users of the system in the first instance. The more everything is potentially up for grabs in future collective decision processes, the less anyone but a majority interest wants to use or contribute to such a system, given the ultimate risk future majoritarian decisions pose to minority interests to any particular governance outcome. Sufficient uncertainty as to future collective decisions can prove to significantly constrain the potential user base in a user-defined system. In cases of financial activity as a proxy for good faith usage of the system, this presents an identifiable margin between the individual costs of the usage and the proportional control of community funds that this expenditure grants each individual. This makes defining the purpose(s) for which community funds will be used, and constraints on this expenditure, essential institutional design features of a system that credibly convince independent users (with varying use and governance preferences) that the system will legitimately protect their interests as against the larger whole.

This report was authored by members of the BlockScience Governance Research Team: Eric Alston, Kelsie Nabben, B & Michael Zargham. With special thanks and appreciation to the Golem Foundation, Wildland team, and the BlockScience team for feedback, including Jessica Zartler for suggested edits.