Written by Michael Zargham.

I went to a place of learning, and learning happened.

This article is an overview of what I came away with after my visit to

Penn’sWarren Center for Network and Data Scienceson April 19, 2018. I gave a well attended seminar ‘On Engineering Economic Systems’ and had engaging discussions with students and professors alike. The slides from my seminar can be foundhere. The best part about returning to Penn was how much these conversations crystallized my thinking. Since founding BlockScience, I had lived mostly inside the crypto-echo chamber and it was refreshing to have brilliant people examining these ideas with expertise in economics and engineering, but with a largely clean slate of opinions.

I’d like to attribute special thanks to George Pappas, Victor Preciado and Amit Gandhi who contributed most extensively to the material presented below.

On Academic Research into Economic Networks

On the academic front, Victor astutely pointed out that research on economic behavior in blockchain networks viewed as a second order dynamical system meets the 3 pillars ideal for academic research:

- opportunity to expand on theory

- availability of relevant data

- ability to have societal impact

To that end, to the extent that it fits with BlockScience goals as a business, I intend to particapte in academic research, probably best suited to INFORMS Journal of Information Systems Research, IEEE Transactions on Control of Network Systems or IEEE Transactions on Network Science and Engineering. Crypto community, please take note of these academic areas. What you are doing is new but tools required to do it right will build on decades of formal systems theory and practice. There are other related fields outside of my immediate academic circles — another suggestion for readers is the Journal of Games and Economic Behavior.

On the BlockScience side, we have genuine expertise and connections to mature thinkers in the space, as well as the team and tools to extract data sets required to flesh out academic papers. On the academic side, I hope to collaborate directly with researchers; there may even be first or second year PhD students who can build thesis on this grounds. With BlockScience, we are developing tools and techniques to advance the “crypto-economics” and “token engineering” practice in industry; it seems collaboration is a net-positive sum game.

On Engineering Economic Systems in Industry

The clarity that came to me about BlockScience, particularly from speaking with George, is that BlockScience is essentially a design firm. The best way to describe what I am doing with my team, besides just saying

BlockScience is a research and analytics firm specializing in blockchain enabled-economic networks,

is that BlockScience is engineering design firm, for a new class of engineered system.

Trent McConaghy coined this type of engineering “Token Engineering” and I think that term is appropriate for the design, implementation and maintenance of an economic system where information is transmitted by tokens. One might note that Electrical Systems have their information transmitted by electricity and that Mechanical Systems have their information transmitted by mechanisms exerting physical forces. Whatever, we choose to call these systems they are in fact engineered systems which provide economic infrastructure in a manner analogous to the transportation network or power grids providing infrastructure enabling social and economic activity.To that end, rigorous design principals, testing and maintenance are critical, because if things break either through decay or attack, people get hurt.

System Design

1. Creating mathematical models of accounts states using networked economic systems framework based on descriptive models of clients

2. Verifying those models and refining them to be mathematically consistent (addressing incentive alignment questions)

3. Sensitivity analysis of the system to violation of constraints

(economic attack vectors)

4. Model testing the incentive “controllers” being proposed under a variety of assumptions (favorable and unfavorable)

5. Providing requirements and recommendations on parameters for smart contracts being developed

System Maintenance

1. Define the critical measures of health in the economic network

2. Design operational analytics for monitoring the health of the economy

3. Develop analytics dashboards (this is the type of development we are prepared to do ourselves, because it’s as much about understanding the economy as it is development)

4. Use model testing code combined with real data to evaluate policies regarding network meta parameters

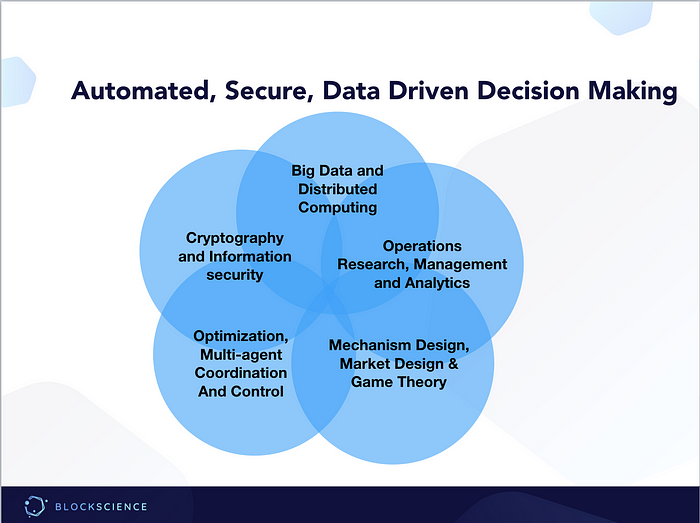

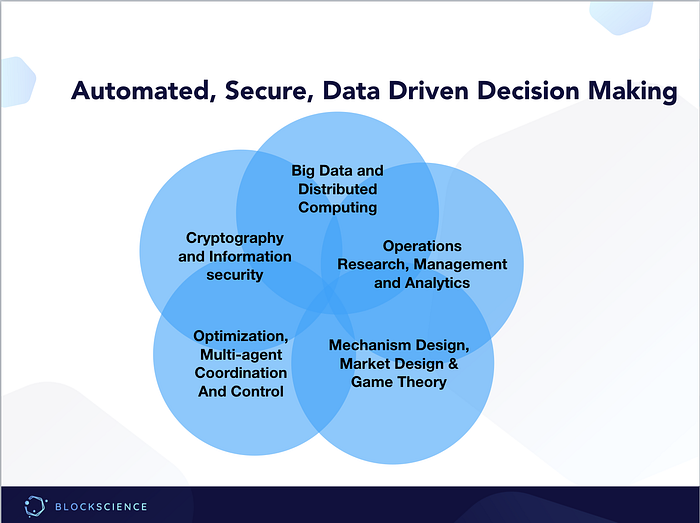

These economic engineered systems are effectively heavily automated business systems and what we are really talking about is a convergence of operations research and multi-agent coordination by engineering alignment between the centralized financial incentives of a business and local financial incentives of consumers and service providers.

Business Architecture in the Era of Blockchain

Thinking about it this way, blockchain infrastructure, allows the automation of some low level financial operations. Amit helped me consolidate what I have learned in the business realm about data driven semi-automated operations

There are at first pass three layers in a tech business

1) The financial stakeholders, generally represented by the Investors, Board and/or C-Suite Executives

2) The operational economics of the business itself — decision making by humans and machines (traditional OR is the optimization of this layer)

3)The technical “plant” of the business, the actual products and services being paid for and how they are delivered

As with any such hierarchical system, the next important step is to examine the interfaces:

1–2) This is what we would traditionally call a business model — often a descriptive model with some spreadsheets to back it up

2–3) Process Models — this is where useful mathematical (technical and/or economic) models enable the OR practice

As Amit and I discussed often the most accurate model in 2–3) is not actually the most useful model. In the case of the blockchain world, this is exactly where our second order networked dynamical systems model comes in. It is not an accurate description of how a cryptographic peer-to-peer network maintains the state of the economic activity, but it is a very useful characterization for optimization and incentive design. This framework is useful for defining models of operational processes occurring via smart contracts in public and private blockchain networks alike. In a sense, the OR practice in 2) becomes significantly more automate-able in a blockchain enabled business.

Conclusion

It is my feeling that these business systems engineering insights themselves are important for building more automated businesses. Effectively, we are applying model based systems engineering to businesses that are open to heavy automation due to highly routine transactional processes. Automation allows the top level financial goals to be engineered in a manner more akin to a robot achieving objectives encoded via potential fields.

Under this paradigm, you could say a blockchain enabled business is a swarm. It seems improbable that entrepreneurs, even brilliant ones with a lot of capital are actually going to recover all the mathematical underpinning required to engineer swarms of economic agents and to consistently meeting their top level goals, without some help from the right academics.

About BlockScience

BlockScience® is a complex systems engineering, R&D, and analytics firm. Our goal is to combine academic-grade research with advanced mathematical and computational engineering to design safe and resilient socio-technical systems. We provide engineering, design, and analytics services to a wide range of clients, including for-profit, non-profit, academic, and government organizations, and contribute to open-source research and software development.