An Exploration of the Control-Theoretic Design Challenge

This piece is an exploration of ‘flatcoins’, which are posed by Coinbase as algorithmic semi-stablecoins that adjust for the rate of inflation. This specific use case poses an interesting control-theoretic design challenge that BlockScience has addressed in several past projects, which we’ll explore further in this article.

Introduction: What is a Flatcoin?

Flatcoins are an emerging token economics concept in which the token of interest, as a store of value, would adjust its valuation over time to track changes in inflation. The stated goal would be to conserve the purchasing power of its token holders and/or a specific group of interest (such as platform users).

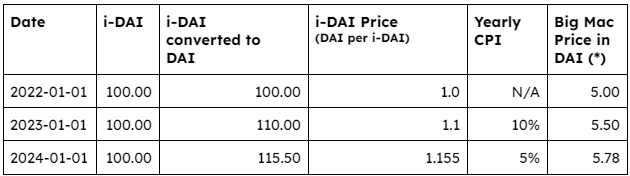

A simple example of a Flatcoin would be the fictional “i-DAI”: an Inflation Corrected DAI. The i-DAI would have its peg attached to a reference time, and its price would be adjusted in real-time in response to changes in inflation, such that the purchasing power for i-DAI holders is conserved. The table below demonstrates this stylized behavior. As we’re going to see over the course of this article, although i-DAI is a piece of fiction right now, it can become reality through the usage of a controller-based stablecoin (CBS), which already exists in production through examples like RAI.

What is Inflation?

In economics, inflation is understood as a general increase in the price of goods and services, which causes a decrease in the purchasing power of holders of the currency being used to denominate prices. In web3, inflation is often (rather confusingly) used to describe the effect of an expanding token supply, although this phenomenon would be more accurately characterized as ‘dilution’ in traditional economic terminology. We will stick with the former definition of inflation for the remainder of this article.

In inflationary environments, currency holders may experience a decrease in their purchasing power, which undermines trust in that currency and the economic system in general. Because of this inflation is considered a key metric of any economy, and central banks around the world have specific mandates to target low annual inflation rates for the fiat currencies they manage (often around 2 to 4 percent). As recent experience throughout the current global economy has shown, however, this is no simple feat.

In light of recent inflationary pressures in the global economy, Coinbase has proposed the design of an inflation-adjusted ‘flatcoin’. The stated goal of a flatcoin would be to “maintain stability in purchasing power while also having resiliency from the economic uncertainty caused by the legacy financial system.” Once again, no easy feat — let’s next examine some of the challenges inherent in flatcoin design.

Flatcoin Design Challenges

To specify a flatcoin is a unique design proposition and as such it contains several challenges that need to be solved, both in isolation and simultaneously. We’ll dive deeper into the details of some of these challenges later in the article. The core challenges are around accurately sensing inflation and creating appropriate incentives.

Specifically, inflation, like many concepts in economics, operates within the paradigm of complex adaptive systems. This means there are an enormous number of dynamic interactions of different factors and variables, including unpredictable human behavior impacting both the causes and effects of inflation. This poses a challenge in flatcoin design, and any implementation will need to remain aware of a number of considerations, including but not limited to:

- Low temporal granularity of inflation indices

- Difficulties around the spatio-temporal regulation of sensor measurement

- Complexity of sensor fusion & effective controller design

- Challenge of actuating changes in the flatcoin economy via appropriate incentives

A Viable Flatcoin Design: Controller-Based Semi-Stablecoins

A promising approach towards building Flatcoins is by reusing some of the most successful stablecoins currently in deployment: the ones that are based on the notion of using controllers as a way to sense price changes and reshuffle participant incentives so that the held token value tends to track a reference value.

These are Controller-Based Stablecoins (CBS), a class of tokens of which RAI is a deployed example. RAI’s inspiration comes from similar theoretical and practical concerns — one of the rationales for RAI adopting a controller is that it has been shown that central bank historical behavior when controlling inflation is well described by a PID controller in its place. This is demonstrated theoretically by Hawkings et al. 2014 and empirically by Shepherd et al. 2019.

Given the stability demonstrated by RAI as a controller-based stablecoin, next we’ll look at RAI as a case study, and introduce the components for a viable CBS-based flatcoin design.

RAI as a Case Study

RAI is a CBS that tends to track the USD value solely by using economic incentives guided by an unsupervised PI controller, together with an oracle that ‘senses’ the RAI/USD price at any point in time.

In terms of user experience, RAI allows users to take over-collateralized loans in RAI by using ETH as collateral. The outstanding debt is denominated in RAI, and the interest rate of that debt (or Redemption Rate, as it is called in the RAI ecosystem) is defined by the implemented PI controller. The loan amount that’s obtainable is determined by what’s termed the Redemption Price, which in practice tends to track the RAI market price closely — with discrepancies typically on the order of 1%.

The logic by which the interest rate is adjusted is based on the discrepancy between the Market Price of RAI (as denominated in RAI per USD), and the Redemption Price of RAI (also denominated in RAI per USD). When the redemption price is above the market price, the interest rate tends to increase. When it’s below, it tends to decrease (or even go negative!).

The reason that the price of RAI is fairly stable, even without pegs and with a volatile asset (ETH) used as collateral, is because of its counter-cyclical incentives. The Market Price is determined by the secondary market of RAI buyers and sellers, and is therefore volatile, and the Redemption Price is determined by the PI controller, and therefore is damped. Consequently, there’s an incentive for rational users to arbitrage when there’s a large discrepancy between the two prices.

Specifically, when the Market Price is above the Redemption Price, it makes sense to take RAI loans, sell them to the Secondary Market for a profit, wait for both prices to converge, and buy RAI from the Secondary Market for paying off the debt for a neutral position. This is especially convenient if the Market Price is above the RP for a long time, as the Redemption Rate can become strongly negative, therefore generating both arbitrage profits and interest rate profits. In any case, profiting from the system tends to make the RAI token market price stable.

As for the opposite situation (Redemption Price Above the Market Price), the profitable action would be to buy as much RAI from the secondary market as possible and hold until the prices converge, or to use it for closing any open RAI positions. The first action tends to reduce circulating RAI from the markets, and the second action will burn RAIs. Both will induce the system towards market price convergence.

The beauty of the controller behind RAI is that all those controller-induced incentives are driven by an external benchmark, namely the RAI/USD price as acquired through an external oracle. RAI does not depend directly on having any USD stocks or liquidity pools in order to achieve its price stability.

For designing Flatcoins, the RAI design represents a natural point for building an MVP, and two things are going to be required: 1) an Inflation Oracle, and 2) a properly tuned controller for the Inflation measurements.

More resources on RAI:

- Reflexer Finance

- Summoning the Money God. Applying Control Theory to… | by BlockScience | Reflexer | Medium

- Workshop #1: RAI Workshops — Modeling the Money God

- GitHub — BlockScience/reflexer: Reflexer Labs, RAI

- GitHub — BlockScience/reflexer-digital-twin: Toolkit based on cadCAD for performing automated routine tests and future predictions for a GEB deployment

A Distributed Control Challenge

Having established that having a tuned controller and an inflation oracle are key components for an MVP CBS-based Flatcoin, we can move to distill the challenges surrounding both.

Measuring inflation comprehensively, due to its spatial, temporal, and composition properties (as elucidated later in this article), is fundamentally a challenge of distributed control system design.

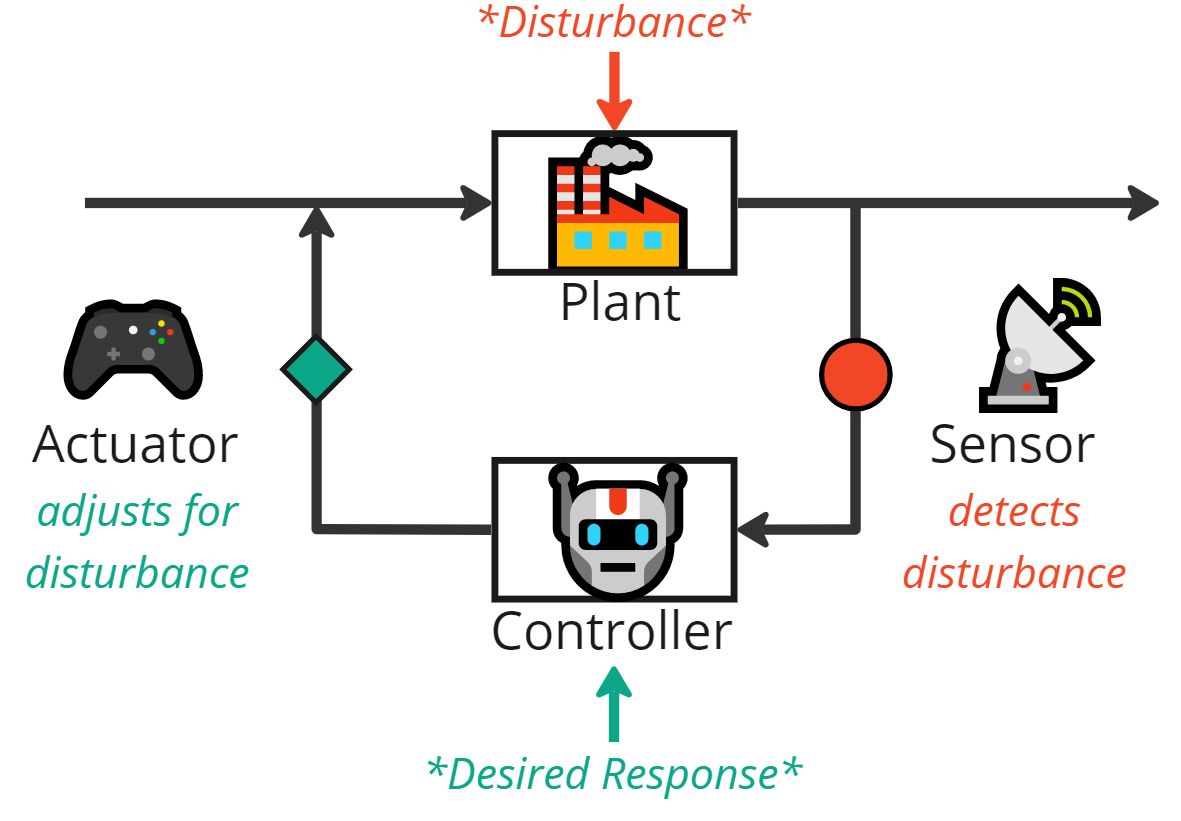

In control-theoretic terms, the flatcoin design challenge can be understood as follows:

- There exists a geographically distributed ‘plant’ that is the market for goods and services, which is emitting price signals for different goods in different places at different times.

- The first step would be to design a set of sensors that pick up on relevant signals (at the right frequency, and from the appropriate locations) and fuse them together on appropriate temporal and spatial scales.

- Those signals can then be fed into a controller in order to be processed into a sufficiently rich model of the world with the goal of estimating the required market interventions into the system, such that the flatcoin value evolves as expected.

- This system would then require actuators to provide incentives that would drive the secondary market to adjust the flatcoin value to stay in line with inflation.

In the next section, we’ll explore some of the basics of control theory, in order to further unpack the design problem.

Understanding Control Theory in Complex Adaptive Systems

Defining the Environment

In control theory, the ‘boundaries’ or environment of a system must always be defined. A model can be defined which understands the world within those boundaries sufficiently well to make controlled decisions within that system. Below we’ll explore the parts of a control system.

Plants refer to the physical or mathematical systems that are being controlled. This could be a mechanical system, an electrical circuit, or even a biological system. Plants originally referred to factories and production plants, which were outfitted with thermostats and other sensors for regulated temperature control.

Sensors are devices that measure some aspect of the plant’s behavior or environment, such as temperature, pressure, or the position of a component. In this scenario, sensors would need to pick up on price changes of relevant goods and services in appropriate locations, in order to calculate and adjust for changes in inflation.

Actuators are devices that affect the plant’s future behavior, such as motors, valves, heaters, or economic incentives to ensure the appropriate price evolution of inflation-adjusted tokens.

Controllers are the brains of the control system, processing information from the sensors and using that information to adjust the behavior of the actuators in order to achieve a desired outcome. The controller calculates the appropriate action to take based on the current state of the system and the desired outcome, using algorithms and mathematical models to help manage the system’s performance.

Together, sensors, actuators, and controllers form the basic building blocks of a control system for a plant, which can be used to regulate and automate a wide range of processes, even in systems with unpredictable human interactions.

Going Deep into Flatcoin Challenges

The Difficulty of Adjusting for Inflation

Any token that aims to track the rate of inflation to mitigate its impact on purchasing power will have to answer some hard questions regarding which ‘sensors’ and information sources are used, such as: “Inflation where?”, or “For whom?”, and “Of what goods & services?”

As economist Blair Fix beautifully illustrates, inflation is not just ‘one thing’. Of course, inflation indices exist, such as the GDP deflator or the Consumer and Producer Price Indices (CPI and PPI, respectively), but these metrics all vary considerably between one another, as well as being dependent upon other criteria (such as geographic location, industry or sector). Indices also commonly suffer from poor temporal granularity, with most being updated on a monthly basis at best, while changes in purchasing power can have an immediate impact on daily life (e.g. grocery or gasoline purchases).

The design of a flatcoin, which (as its name implies) would retain a ‘flat’ purchasing power profile in spite of price changes, must carefully consider its intended scope and reach before it is implemented. An inflation-adjusted token may have to contend with high levels of price volatility, such as hyper-inflation, in some geographic regions or sectors for extended periods of time, while simultaneously adjusting for low volatility and a lack of inflation in other areas.

In addition, the selection of which inflation measure to choose is challenging, as inflation may vary significantly even on a national, regional, or metropolitan level. And standardized inflation measures, such as the CPI, do not account for variations in purchasing power across groups comprised of different professions, investments, and socioeconomic or demographic compositions.

Finally, from an implementation point of view, and adding to the complexity of the design challenge, the accurate and timely measurement of inflation poses a particularly difficult oracle problem, given the susceptibility of such a token to potential manipulation. Since the actuators of the flatcoin system will depend upon the reliability (and ‘unimpeachability’) of the oracle sub-system, their design is also far from straightforward.

Towards Flatcoins in Production: A Proposal to Move Forward

The spatio-temporal difficulties of this particular problem are considerable, and there are open design problems that could be very interesting to tackle from the perspective of using control theoretic methods to create the appropriate incentives for an algorithmically-regulated token economy.

In the spirit of agile methodology, we recommend a feature-minimized PoC design and pilot implementation, to reach an initial set of design goals that satisfy initial requirements. The PoC could be designed for feature upgradability to more complex implementations, as iterated design challenges continue to be solved for upon further specification and prioritization.

One departure point is to constrain first the spatial component of inflation. A simple and recommended proof of concept (PoC) design would be to start with a regionally-indexed flatcoin within a single currency market and a scalar price index, although this simple design may face various arbitrage challenges.

On longer design timescales, a global composite index inflation token would address those arbitrage difficulties, and would thus have more robust use cases, but would require significantly more conceptualization and design to address the myriad challenges presented throughout this article. As the first PoC is deployed and evaluated, additional requirements and affordances could be put forward for the incremental research & development of the sensors, controllers, and actuators that are needed for a truly effective flatcoin at global scale, which would be comprehensive of diversified and multi-spatial indexes.

This article written by Jeff Emmett, Danilo Lessa Bernardineli, and Jamsheed Shorish, with input from Michael Zargham.

About BlockScience

BlockScience® is a complex systems engineering, R&D, and analytics firm. By integrating ethnography, applied mathematics, and computational science, we analyze and design safe and resilient socio-technical systems. With deep expertise in Market Design, Distributed Systems, and AI, we provide engineering, design, and analytics services to a wide range of clients including for-profit, non-profit, academic, and government organizations.