A Rapid Report on the Arguments and Technicals of Recent Filecoin Improvement Proposals

This piece is an analysis of the benefits and drawbacks of FIP-0056 and the larger SDM vs. CDM debate that is ongoing. This work was completed at the request of the Filecoin Foundation and aims to be an independent, first-principles review that was carried out by the BlockScience team, who have spent years designing and building tools for the Filecoin ecosystem.

Table of Contents

- Executive Summary

— Diagnosis

— Recommendations

— Glossary - Introduction

- Part 1: A Technical & Comparative Review of the Proposals

— Proposal Summaries

— A Brief Intro to Filecoin Economics

— Implications: Reshuffling QAP Share; Token Distribution in terms of Collaterals and Available Supply; Termination Fee - Part 2: Debate Analysis

— Non-discussed Concerns: The Termination Fee has not been properly discussed; Expressing the proposal through a functional form rather than a fixed form.

— Debated Concerns: The resulting redistribution of Token Wealth towards FIL+; FIP-0056 will cause increased capital costs to Storage Providers; FIL+ is overpowered in terms of its Quality Adjustment Factor; Providing alternatives for non-FIL+ sectors

— Thesis: Deal Demand is blocked by technological rather than economic hurdles

— Meta-Concerns: Studies that are non-reproducible; Studies that are not inclusive of the community worldview; How representative is the public debate, compared to the populations actually affected? - Part 3: How to Move Forward

— On The Sector Duration Multiplier

— On Community Oversight and Participation in FIP Studies

— On Fostering Community Understanding of Filecoin Economics - Appendix

Executive Summary

On the Technical details of the Proposals:

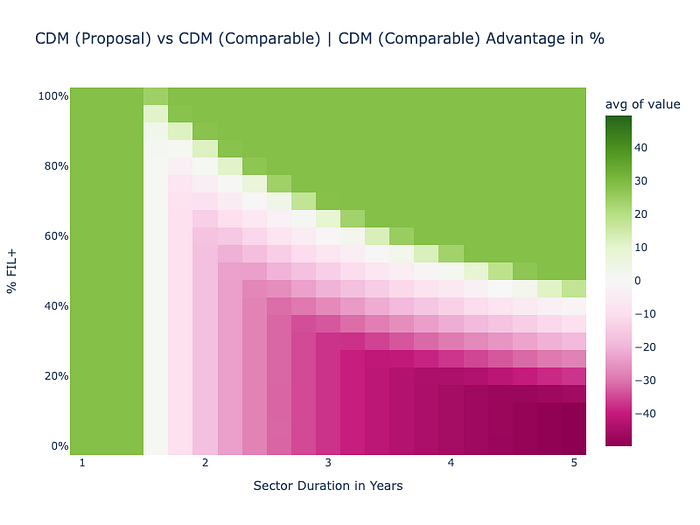

- Both FIP-0056 and CDM favor Long-Duration CCs with different patterns and intensities compared to the Current Active Algorithimical Policy (Now). CDM does so heavily, while FIP-0056 does so slightly. FIP-0056 can be better for long / fully-filled FIL+ sectors and CDM for shorter / slightly-filled FIL+ sectors. FIP-0056 doesn’t actively disincentivize any sector, while CDM does so: it generates a virtual penalty for having too much FIL+.

- Both proposals can increase the amount of Locked Filecoin for 1–2 years, with CDM having a more substantial effect.

- The Termination Fee Cap Modification in both proposals should be removed and proposed as a distinct FIP.

- CDM can take either the proposed or an FIP-0056 like parametrization. The latter will have a more balanced QAP Share among participants and less effect on the temporarily increased Locked Filecoin.

On the debate and general recommendations:

- The friction in the process could be improved by segmenting it according to the steps described in the Computer-Aided Governance in Action. If FIP-0056 is to be postponed/rejected, we recommend using it as the source document for the workflow around a new proposal so that there’s a soft agreement between requirements, forms, and parameter values on all steps of the process.

- The debate has exposed multiple concerns. All are legitimate in intent, but not all in factual basis. We provide a extensive review in this document.

- FIL+ has been a focal point of disagreement among participants. We recommend that the community has space for open discussions around its role and functions and how it fits into the various Vision(s) for the Network.

- Community Oversight of the analyses surrounding FIPs and additional Educational Efforts are to be suggested.

On our recommendation around the Decision:

- We recommend Postponing or Rejecting FIP-0056 as per application of the Precautionary Principle on the Technological Hurdles & RBP as Key Advantage thesis as advocated by the CDM Proponents. If that thesis is taken to be Unlikely or False, then the Recommendation is Void towards FIP-0056.

- An underlying thesis behind CDM relates to technological rather than economic hurdles being blockers to Filecoin Adoption. If Filecoin’s RBP size is considered a key advantage, then there’s a catastrophic risk of interfering with the CC’s economic calculus. With the currently available information, we are unable to disprove that Thesis.

Diagnosis

On the technical comparison of the FIP-0056 and CDM proposals:

- Both proposals will have long-duration CCs as their primary beneficiaries and short-duration CCs as the main negatively affected party.

- Contrary to the discussion, FIP-0056 does not bias QAP towards FIL+. Unless CCs are disproportionally risk-averse, FIL-0056 is CC-biased compared to Now.

- FIP-0056 will favor mostly long-duration FIL+ sectors, especially those filled with FIL+. CDM will disproportionally shift incentives from fully-filled sectors with FIL+ toward other parties. Partly filled FIL+ can benefit from CDM in several circumstances.

- Both proposals can potentially increase Locked Filecoin Supply, with CDM being stronger than FIP-0056.

- An incentive flaw has been encountered regarding the Termination Fee Cap in both proposals, which is even ‘quirkier’ in CDM.

On the Debate:

- The debate process exposed multiple concerns. Some were legitimate in intent and factual basis, while others had honest intent but weak or even misleading factual basis.

- Most of the former fell into two categories: 1) FIP-0056 skewing the Token Wealth Distribution even more towards FIL+ sectors and 2) mistaking Network-wide phenomena with Individual phenomena (e.g., lower network-wide rewards means lower rewards for the individual miner that remains / onboard all things being equal, which is not true).

- The debate made clear that the FIL+ incentives are a central point of contention in the public debate as of now.

- A misconception is the equivalence between FIP-0036 and FIP-0056. The latter doesn’t modify the Consensus Pledge, and it has a far gentler slope.

- Issues around study reproducibility and perceived relevance toward stakeholders as consumers of studies were identified.

- A concerning thesis has been propagated by the CDM proponents, which, if true, poses a catastrophic risk to the Network’s Success. Given the impossibility of disproving it and the perceived non-criticality of the FIP-0056 modification, we opt to employ the Precautionary Principle for the recommendations.

Recommendations

On the Proposal’s Technical Structure:

- FIP-0056: Remove the Termination Fee Cap dependence on SDM from FIP-0056 and make it a separate FIP.

- CDM: Consider FIP-0056 equivalent parameter choices

- CDM: Remove the Termination Fee Cap dependence on SDM entirely.

- CDM: Consider soft transitions rather than caps on the Quality Multiplier.

General:

- Community Oversight on the FIP Analysis should be increased through either external stakeholder involvement during its execution or usage of independent FIP reviewers

- Educational Content coverage on Filecoin’s Economics and Protocol must increase Quantity, Reach, and Quality.

- The community should be stimulated to discuss the Storage Market in terms of its state, challenges, benchmarks, and required actions & incentives. The inherent risks and the role of Filecoin’s endogenous economy around the transition towards a Storage Marketplace / FVM-dominated world should be the topic at large.

If FIP-0056 is not approved:

- Go back to first principles: formally describe the problem that should be solved (e.g., ‘we should incentivize longer sectors,’) and what mechanisms can be used to support that. Select the mechanism(s) based on diversity-of-interest criteria: the best one is the one that can be tuned to manage trade-offs across different utility functions.

- Break down the solution proposal into two FIPs:

- The first should decide the mechanism (e.g., ‘we should have a Sigmoid SDM regardless of the numbers). This determines the Class of Incentives that are achievable.

- The second should determine the actual numbers (parameters) that tune the mechanism. This instantiates the Actual Incentives that are to be realized.

On Taking a Decision Immediately:

- FIP-0056 should be postponed or rejected if the “Technological Hurdles & RBP as Key Advantage thesis” validity is considered Unknown or Likely to be True.

- FIP-0056 does not appear to be intrinsically ‘bad’ or ‘good’ for the FIL ecosystem. However, in Engineering work, the precautionary principle always applies. If the expected benefit doesn’t clearly outway the potential risks, postponing is always a safer option.

- The same precautionary principle applies to CDM as of now.

- A possible concession is to utilize the more general proposed CDM form and set it so that it has FIP-0056 behavior: Ceiling on 20x and slope = 0.287. The definition of those two values could be the subject of a poll.

- CDM, as being proposed now, should be modified before being considered

- We could not find a compelling public argument making the case that FIP-0056 is an urgent intervention.

Glossary

SDM — Sector Duration Multiplier

CDM — Capped Duration Multiplier

FIP — Filecoin Improvement Proposal

QAP — Quality Adjusted Power

RBP — Raw-Byte Power

TF — Termination Fee

CC — Committed Capacity

Introduction

Overview and Purpose of this Review

This report is an independent effort by BlockScience to perform a first-principles-based review and compare the FIP-0056 (i.e., SDM) and CDM proposals. It has been instigated and funded by the Filecoin Foundation due to the controversy generated by recent proposals and the consequent need for an independent technical group to read through the arguments, check them, and evaluate their implications.

This document has three parts:

Part 1. Technical Review of the Proposals

Part 2. Review of the Community Debate & Artifacts

Part 3. Our proposals on how to evolve further

Part 1 of this review is a Technical Review of the proposals on which we make specific suggestions for the Proposals while describing their general behavior in light of how Filecoin Economics works.

However, Filecoin is a complex socio-economic system. Technical analysis is not a substitute for participants discussing their motivations and how to affect those through the Protocol. In light of that, we comprehensively review the debate and synthesize it in Part 2. This is followed up by Part 3, which provides our recommendations regarding the general process.

Who Is BlockScience?

BlockScience® is a complex systems engineering, R&D, and analytics firm. Our goal is to combine academic-grade research with advanced mathematical and computational engineering to design safe and resilient socio-technical systems. With deep expertise in Blockchain, Token Engineering, AI, Data Science, and Operations Research, we provide engineering, design, and analytics services to a wide range of clients including for-profit, non-profit, academic, and government organizations.

Our R&D occurs in iterative cycles between open-source research and software development, and application of the research and tools to client-based projects. Our client work includes pre-launch design and evaluation of economic and governance mechanisms based on research, simulation, and analysis. We also provide post-launch monitoring and maintenance via reporting, analytics, and decision support software. With our unique blend of engineering, data science, and social science expertise, the BlockScience team aims to diagnose and solve today’s most challenging frontier socio-technical problems.

We’ve been involved with the Filecoin ecosystem for (as of this writing) over 3 years, and we’ve supported several workstreams both with Protocol Labs and Filecoin Foundation that helped to design, prototype, and monitor the Filecoin Economy as well as more recently to research and analyze governance.

Some of our prior public artifacts include: supporting Filecoin’s economy design before launch. Monitoring through the first wave of sector expiration and the first baseline crossing. Describing Filecoin’s Cryptoeconomic Mechanisms in terms of KPIs and Counterfactuals. Surfacing High Impact Research Topics for Filecoin Cryptoeconomics. Support on Design & Optimization for the Retrieval Assurance Protocol. Building an Educational Calculator for exploring Baseline Minting and among others.

More about the collaboration can be found in the BlockScience + Filecoin Collaboration Book.

Part 1: A Technical & Comparative Review of the Proposals

Overview

In this technical review, we’ll distill the proposals and their effects using a first-principles approach. As we’ll see, contrary to what’s widely understood, the Proposals are not orthogonal or directly opposed. In fact — with different intensities — both Proposals are undesirable for all sectors that are 1) short-medium duration and already 100% Filecoin Plus (FIL+) filled and 2) short-duration Committed Capacity (CC). Conclusions become more nuanced, however, when we look into heterogeneous combinations like partially filled FIL+ sectors.

In addition, it is also concluded that 1) sudden changes in the Quality-Adjusted Power (QAP) can induce transient effects on the Token Distribution, and 2) the Termination Fee Cap will scale with SDM. These effects will be described shortly.

One aspect to have in mind when discussing the effects of interventions on the Filecoin Economy is to understand the scope of both assumptions and measurements. As much as possible, we’ll restrict our analysis to what’s endogenous to the system, although we should have clarity that desirable outcomes have dependencies on exogenous aspects that are not fully understood.

The following figure provides a stylized, animated snapshot of the linkages between the endogenous economy, the hard-to-answer dependencies, and one of the things that we should be optimizing for (even though the latter can vary depending upon individual respondents).

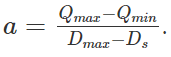

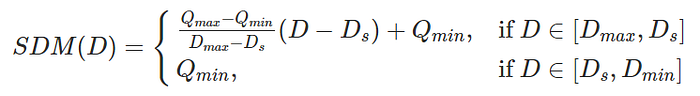

A key assumption that was made for this analysis is the existence of a “CDM Comparable” proposal, which has the same parameter values as those contained in FIP-0056, and which is assumed to have the functional form[1] given below. This provides a formulation on which will be possible to compare the FIP-0056 and the CDM proposals, especially by taking the slope as being

On which we have the following nomenclature: Qmax and Qmin are the Maximum and Minimum Quality Factor due to Sector Duration, Dmax, Ds, and Dmin are the Maximum, Transition, and Minimum Sector Duration, and D is the Committed Sector Duration.

On that formulation, FIP-0056 and CDM Comparable are characterized by Dmax=5, Ds=1.5, Dmin=1, Qmax=2, and Qmin=1, therefore rendering a slope of a≈0.286. CDM Proposed is characterized by Dmax=10, Ds=1.5, Dmin=1, Qmax=5, and Qmin=1, which gives a slope of a≈0.471.

Proposal Summaries

Below are two tables covering the content and the effects of the two proposals. The first table is a succinct description of each proposal’s characteristics and their commonalities which are indicated in parentheses in the cells.

The second table indicates the expected effects of each proposal as justified by the technical review. The Ordinal QAP Share Increase section provides, for the rows following, a measure of “how much” one expects the QAP Share of a given group to increase from an all-things-equal (ceteris paribus) perspective. The numbers indicate how much relative change is to be expected compared to “Now,” i.e., at the time of this writing (For example, if all numbers are positive, then all proposals are better than “Now,” while a proposal with a negative number indicates that its outcome is worse than “Now”).

A Brief Introduction to Filecoin Economics

The Filecoin economics ecosystem is characterized by the multitude of mechanisms that it has and by their complex interconnectivity. Rather than simply being a “primary market” for the world, Filecoin has a series of levers and counter-levers that can be controlled to ensure that the Storage Economy is reliable.

The two metrics of Storage Provider Revenue through Rewards and the Storage Provider Collateral Requirements are the more visible aspects of the FIL economy and the ones which have instigated the most discussion around FIP-0056 and FIP-0036. As such, we’ll provide a brief introduction to them while making explicit that although important, they’re not the sole determinants of Filecoin’s economics.

Miner Rewards

Let’s start by defining what actually generates rewards from Storage Mining: it is the mixture of Simple Minting (which depends solely on time) and Baseline Minting (which depends solely on the Raw-Byte Network Power). In this sense, the only ‘actuator’ that anyone possesses to increase network-wide minting is adding more Raw-Byte Power (RBP).

However, there are two tricky aspects to this immediate conclusion that deserve mention:

- The Miner Reward is not necessarily correlated with network-wide minting. What matters is the expression

In addition, Miner Rewards do not equate to Miner Utility. The latter may depend on endogenous aspects, such as the Initial Pledge per 1 unit of QAP and the ratio of locked per circulating FIL. It may also depend upon exogenous variables like the future FIL price, the average deal revenue, and so on. Lastly, the relative importance of the reward to other concerns can vary among groups. Although considering the Reward as a proxy for Miner Utility is useful, we should not make an equivalence of it.

2. The marginal Block Rewards for added RBP do not scale linearly when the Network is below the baseline. Increasing the RBP by 10% will increase the Baseline Rewards by less than 10%, and Simple Rewards will be unmodified. In that sense, for a constant FIL price scenario and for constant quality factors, lower Network QAP will always be better for a simplified miner optimization goal.

As a stylized example, consider the following: suppose that the Network has a constant Average Quality Factor for all sectors. If the Network RBP is 80% of the Baseline, then the following conclusions hold against a 100% Baseline Scenario:

- Network, Simple, and Baseline Minting will be at most 15%, 0%, and 20% slower, respectively[5]

- Per-QAP Miner Reward will be 10% larger

Lastly, Miner Revenue should come from a mix of Sector Rewards and Deal Revenue. The latter fundamentally depends on Deal Price and Deal Count and depends on factors that are outside the scope of an endogenous model. Those can only be answered through demand-side studies and may interact considerably with aspects like product state, marketing, etc. Some forms into which the latter can be implemented are referenced in the Surfacing High Impact Cryptoeconomics Research Topics on Filecoin Document, mainly Initiatives 3 to 5.

Quality-Adjusted Power (QAP)

Having grasped the effect of Mining Rewards, we may also clarify the role of QAP for an individual: it controls the weight of someone’s stake on the Network. More QAP means a larger share of the Minting Rewards and the associated endogenous capital costs. A larger QAP/RBP for a group means that it deserves more shares relative to its physical contribution for the Network.

The rationale for groups having a larger QAP in proportion to their RBP is based on the notion that certain behaviors on the Filecoin Protocol can be more valuable and therefore worthy of stimulating through additional Block Rewards. The most basal commitment that one could do for the Network is to prove that they have available storage that’s compliant to the Protocol Requirements. That’s Capacity Commitment. Regular Deals is an added layer of commitment, although it can suffer from Self-Dealing issues, and as such, it is not incentivized as much. Finally, as a way to bootstrap Demand on the Filecoin Ecosystem for Storage Deals, there’s the Verified Deals notion. What makes a Deal being Verified is the subject of the FIL+ program.

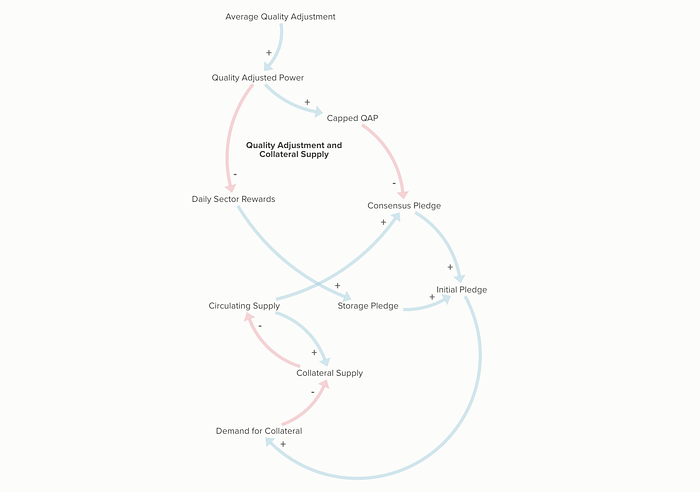

Beyond the role of QAP itself, changes in the QAP trajectory can be the generating cause of specific economic effects, as Filecoin’s economy has a series of mechanisms that contain feedbacks loops (the Consensus Pledge and its effect on the Circulating Supply is perhaps the most notable of these, cf. the figure below).

Implications

Given the above components of the Filecoin economy, we’ll now review two aspects of the proposals: the reshuffling of QAP per the proposed forms and parameters, and its effect on the Locked Supply given an immediate adoption for a stylized scenario.

Reshuffling QAP Share

Summary: All proposals will favor long-duration CC Sectors compared to Now. FIP-0056 will favor all types of long-duration sectors (with a slight pro-CC bias) compared to Now. CDM will favor mostly Long-Duration CCs compared to Now. CDM slightly favors medium-Term (1.5 yr to 3yr) Partial FIL+ sectors. FIP-0056 slightly favors Partial FIL+ that are above 4yr+.

Inferring the specific impact of changed QAP multipliers can be difficult. Changing who gets the rewards, by how much, and under what conditions has the potential to change the demand constraints and, as such, induce different strategies for participating in the network.

Without demand-side studies on the elasticities and non-linearities, any conclusions originating from endogenous models are likely to have untested assumptions.

With that in mind, we choose to make the most assumption-free analysis possible by using the insight that QAP is a representation of the Reward Shares: compute the QAP relative advantage that a single sector would have on one proposal against another, and de-bias it by correcting by the mean. Then, rank it by percentiles. The ones that don’t have an obvious advantage on any side are computed to be zero.

When doing that analysis for a variable FIL+ / Sector Duration choice, the final result is that roughly half of the cells will favor one proposal, and another half will favor the other. By enforcing that duality, it is possible to visualize the groups on which the advantages are ambiguous.

By comparing all pairs of scenarios, we can distill which of the proposals is more beneficial given the options. This is done by using the Ordinal Comparison criteria.

If the situation for a specific group is relatively close among scenarios, we also introduce soft assumptions for disambiguating. One example is the fact that CCs can choose arbitrarily long durations, while FIL+ sectors can be restricted by the Deal Durations. Because of this situation, SDM will disfavor the current 100% FIL sectors over Now on a specific scenario in which partially-filled / CCs choose to maximize their duration.

Token Distribution in terms of Collaterals and Available Supply

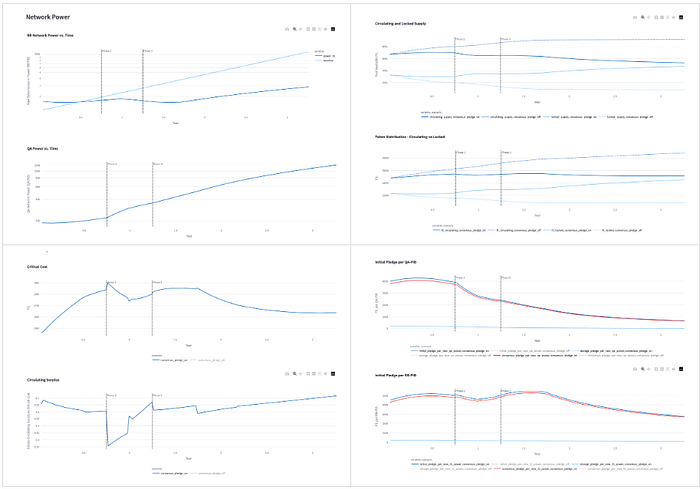

Summary: The adoption of any proposal will increase the Locked Fraction of the Supply due to transient effects caused by the increase in the Quality Factor. The Proposed CDM has a higher locking potential because of its higher multiplier and accessibility. The effect should wash off after some years.

A non-trivial feature of Filecoin Economics is the Feedback between Network Power, Collaterals, and Circulating FIL supply.

One way of putting it is given in the figure below. If Sector Adjustment goes Up, then Collateral Requirements per Sector will go down, which reduces demand for Collateral, thereby Increasing Circulating Supply and making Collateral Requirements go up. This in turn makes Circulating Supply go Down and Collateral Requirements go down. This cycle can then continue in this fashion forever.

Although fascinating, observing those feedback cycles in real-life can be difficult due to the time granularity, as the cycle is iterated per epoch: every 30 seconds, while most metrics are daily or hourly based. Also, the Circulating Supply does have other in/out-flows: The Rewards being Unlocked, the FIL being Vested, and the Filecoin being burnt. Lastly, some of the measurements on Filecoin Economics are filtered through the Alpha Beta Filter.

The main point, however, is that the only way to make sense of this is by building formal models and performing simulations. Due to the difficulty of acquiring intuition around the Consensus Pledge, BlockScience has built an Educational Calculator that allows anyone to experiment with different scenarios with ease. This is a user-friendly cadCAD-based dashboard that allows anyone to experiment with different simulations on stylized scenarios. It is a toy and non-calibrated version of the so-called Operational Digital Twins, which allows someone to monitor and intervene on a system being modeled in quasi-real-time.

By using a 3-phase scenario, it is possible to perform a stylized simulation of what would happen if SDM/CDM is approved. Let’s assume that the current RBP is on a constant trajectory for the following four years. Let’s also assume that after one year, there’s a 3-month period where the average Sector Quality Factor goes from ~1.5x to ~4x, and all sectors during the period are allowed to Expire. After that, the Network will keep a ~5x Sector Quality Factor and a 6% monthly renewal rate. By doing that, we have an educated-guess estimation of the trajectory if SDM/CDM is approved, as their effect is solely to increase the QAP.

The visualizations for that stylized simulation are shown below. What is likely to happen is that the Initial Pledge per QAP will generally fall. However, the Consensus Pledge tends to have a delayed response because of the feedback effects, and as such it will generate a transient effect that has a duration of between 1 and 2 years during which the Locked Supply Fraction of FIL will jump, almost immediately, by some percent (depending upon how this is measured). Importantly, this does not change the Security calculus, as the Initial Pledge per QAP will decrease as the Locked Supply Fraction goes up.

After a longer period of time (on the 3 to 5 year scale), the transient will wash out and primary effects will have disappeared. It’s worth pinpointing that the effect can be very real on the user experience and learnings, as well as with the interactions with other subsystems, including exogenous ones. In practice, a transient effect will leave a permanent marker on the future trajectory.

In that sense, the proposals are not important for the long-term evolution of Token Distribution but can introduce a transient state that could affect the Storage Providers’ experience / Secondary Market expectations.

And for that transient, what matters is the Average Quality Factor during the transition time. The Proposed CDM will likely have a bigger transient effect over the FIP-0056 / Comparable CDM environments because its maximum duration multiplier is higher (5x) and is readily accessible to most participants.

Termination Fee

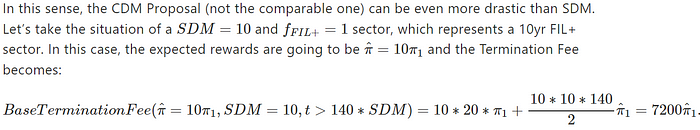

Summary: All proposals will increase the Termination Fee in excess of Rewards due to SDM. FIP-0056 makes the Termination Fee grow faster than the Rewards — CDM also does this, and in addition actively penalizes sectors with “excess” FIL+ deals.

Let’s start with the Termination Fee growing faster than the Rewards due to SDM. This happens because the Termination Fee already scales by the Sector QAP through the expectedRewards variable, since 2x the Quality Adjustment means 2x Expected Rewards. By adding the sdm multiplier on the Cap, there’s a disproportional increase in TF.

Namely, a Sector with SDM=2 will need to incur ~4.6x more fees than an SDM=1 sector. This can be showcased by the following:

This is a 4.6x Fee increase for a 2x increase on Expected. By dividing both, we conclude that FIP-0056 can cause, at most, a 2.3x Fee Increase per 1x Reward Increase.

That’s an 80x increase in the Termination Fee for 10x more rewards! CDM as proposed can cause at most an 8x Fee Increase per 1x of Reward Increase.

One issue with CDM is that if SDM=1 instead, then there would have been a 10x increase in the Termination Fee for 10x more rewards. It is possible to have the same rewards without increasing the Fee. This is not possible with FIP-0056.

As such, the CDM proposal actively punishes sectors that have “excess” FIL+ deals through the Termination Fee. They incur externalities without any addition to the incentives. The FIP-0056 proposal, even though it makes the Termination Fee grow faster than the Rewards, does not contain such disincentives.

Because of Termination Fee behavior, we are unable to recommend the CDM-as-proposed if it contains the Termination Fee Cap Modification.

Part 2: Debate Analysis

In this part, we’ll provide an analysis of the undergoing SDM / CDM debate as proxied by the arguments on GitHub and Slack. We’ve read through most, and based on our own distillation from the different stakeholders, we’ve created Groups and Items of Debate, which will allow us to understand and discuss them separately. This is required as FIPs are technical proposals and soft community governance processes. Understanding their concerns and theses is important for the impact and legitimacy of the decisions.

Summary

- The existing studies & analysis need to include the community concerns & requirements comprehensively and straightforwardly.

- There are misunderstandings on both sides about how Filecoin Economics actually work, regarding QAP dynamics and how the Macro Filecoin Economy affects the Individual Miner Economy.

Concerns that Haven’t been Discussed

First, we’ll delve into concerns that were raised from the Technical Review, but require more focus in the public debate.

1) The Termination Fee has not been properly discussed

As noted in the Technical Review, the Termination Fee under FIP-0056 will grow larger than the Participant Stake on the network as measured by the Expected Rewards. As such, the proposed cap is biased against Long-Duration sectors, regardless of the type. We could not find public discussions or analyses on this specific point during our research. This modification is novel and was not present within FIP-0036. Our perception is that the community is unaware of this modification and its consequences.

2) Expressing the proposal through a functional form[1:1] rather than a fixed form

The engagement in the debate did seem partisan in the sense that either a discussant would agree with one of the proposals, or would agree with another. No room was made for first agreeing on the general form and incentives that a solution should satisfy, so that a search for suitable parameters could be performed. Only at the end, because of a technical inquiry, did discussions around an additive or mixed form start appearing.

Debated Concerns

In this section, we’ll review some of the concerns that were made available publicly and assess their validity in light of the protocol workings and the proposals that were forwarded.

1) The resulting redistribution of Token Wealth towards FIL+

This is likely the main source of contention in the debate, as there’s a wide discourse stating that FIP-0056 will skew the Resulting Token Wealth Distribution towards FIL+ sectors. As shown in the Technical Review, this is not true (although the discussion is nuanced).

Assuming a scenario in which All Sectors increase their lifetime by the same factor, the Resulting Token Wealth Distribution will continue to be the same as of Now. However, the type of the sector matters. CC Sectors will have a bigger elasticity to incentives, while heavily FIL+ dependent sectors will be restricted on deal durations and deal demand.

Another way of putting it is that in a scenario of “everyone increases their sector durations by the same amount”, the incentives will continue to be as of Now. But as we introduce real constraints, they tend to go in the direction of limiting the FIL+ QAP.

In practice, CC sectors are more able to take advantage of the Longer Sector Durations, and it is expected that they will increase their share of the QAP — slightly so with FIP-0056, and significantly more with CDM-like proposals.

What can invalidate the above analysis is if CCs are more risk-averse than FIL+ dealers. If so, this could mean that they do require a higher discount rate for compensating the temporal opportunity risks. In that sense, the 2x multiplier provided by FIP-0056 for a 5yr sector is equivalent to a 16% annual discount rate over having 1x/1yr, and the 5x provided by CDM for a 10yr sector is equivalent to a 17% annual discount rate over 1x/1yr. Whether this is enough or not should be debated by the community. Right now and periodically, with an eye for the outcomes being generated and being expected.

2) FIP-0056 will cause increased capital costs to Storage Providers

One concern is that adopting FIP-0056 will make the Collateral / Capital requirements significantly larger than they are now, therefore making storage provision infeasible. This can be True in the short-term (1–2 months) and False in the medium/long-term (more than 6 months).

As discussed in the Technical Review, there is a transient state caused by the delay between the Consensus Pledge response and the Circulating Supply changes. Given the current trends, it is possible that the adoption of FIP-0056 / CDM will make the Initial Pledge per RBP fall more slowly than normal. It is important to note that any effect caused by FIP-0056 on this aspect will be magnified if CDM is adopted instead.

The Initial Pledge per QAP will still fall reasonably fast, so this should be considered a minor risk factor for Storage Providers that use Filecoin as their unit of accounting.

However, if the unit of accounting is based on fiat currency, then there may be an increase/decrease in the Locked Supply / Circulating Supply, which may or may not affect secondary markets.

By using stylized simulations, it is expected that FIP-0056 approval could introduce a ~5% decrease in the Circulating Supply, and CDM could introduce a ~10% decrease, although producing exact figures are not the subject of this Review. The exact elasticity of Fiat/FIL towards Circulating Supply is unknown, so this may or may not be a risk factor.

3) FIL+ is overpowered in terms of its Quality Adjustment Factor

Filecoin has had a 10x Quality Multiplier since its launch, although the numbers that were considered during design-time were as high as 50x and as low as 2x. The stated goal was to accelerate Filecoin’s transition toward a Useful Storage Marketplace, and its functional goal was to bootstrap Demand on Filecoin’s transition from a Reward-Based economy towards a Deal Revenue based one by facilitating hitting a critical mass of Activated Deals.

Although noble, some concerns have been raised regarding whether FIL+ is actually fulfilling its function, or if it is acting instead as a Token Wealth redistribution mechanism with no added value. In addition, concerns have been raised in relation to the Protocol Security / Decentralization, and the ensuing debate has several similarities with (and differences from) the debate around Proof-of-Work vs. Proof-of-Stake from other blockchain environments.

Providing a straightforward answer about this concern is impossible as per this Review. There is not enough readily accessible objective data for building a “What If FIL+ was 2x or 20x rather than 10x” scenario. As such, that concern should be addressed politically (i.e. in a governance capacity) for now, and research must be done in order to better evaluate the impact of FIL+ in terms of elasticities and opportunity costs.

As for the proposals themselves, it is worthy of note that FIP-0056 is not as FIL+ friendly as it is perceived to be. Long-Duration CCs will be better off in all situations, and partial FIL+ sectors may be better off with CDM in some circumstances. It is realistic to imagine that most of the marginal gains will go from Short-Duration CCs / FIL+ towards Long-Duration CCs (mostly) and Medium/Long-Duration FIL+ (not as much).

CDM (especially the proposed version), however, is actively adversarial to FIL+ in most instances, except for sectors with low FIL+ fractions. In that sense, the proposal can partially be understood as an answer to this concern.

4) Providing alternatives for non-FIL+ sectors

A concern that has been highlighted is the infeasibility of having a non-FIL+ based economy through Regular Deals. In that direction, Filecoin formalizes two sources of revenue for SPs: Block Rewards and Deal Revenue.

The first is limited by the FIL Issuance, which is a total of 1.1 Billion FIL, and of those, 268 Million (24%) have been issued already as of March 21st.

The second depends on transaction cycles around the FIL Circulating Supply. An interested party will purchase FIL from the secondary market, which will transfer it to the SP, which will sell it back to the market, creating a cycle. And because it is a cycle, the exchange price is free to be anything, as long as Demand and Supply are matched.

As of now, the amount of Circulating Supply available to facilitate those exchange cycles is around 407 Million Filecoin as of March 21st.

A positive aspect of realizing those transaction cycles is that they can keep turning ad eternum. And if the currency gets into a deflationary state, then there’s pressure for the price level to go up over time.

Identifying and facilitating those cycles should be the community’s priority. In the long run, only so much FIL can be mined. What will ensure a sustainable economy with the outside world will be the storage markets. There’s only so much that an endogenous recirculation of FIL will accomplish without incurring a healthy trade balance with the non-FIL world.

Thesis

Deal Demand is blocked by technological rather than economic hurdles.

An intriguing thesis put forward by CDM proponents states that the main blockage point for fostering the Deal Marketplace, especially in a decentralized, organic way, is technological rather than economic.

An economic explanation for the Demand for Deals would be that the number of potential deals the network could have at any instant is determined by its elasticity with respect to the Market Deal Price: the value that is being determined on average on the Storage Marketplace.

If the Market Deal Price goes down by 2x, then the Number of Potential Deals should go up by some number. The relationship may be linear or not. It’s not uncommon to have certain thresholds where the Number of Potential Deals could explode, or (by contrast) tend to zero almost immediately.

However, it may be that the Number of Deals is inelastic with respect to the Market Price: making the price go up or down won’t change anything on the demand side. In this case, the explanation must be looked into outside of the direct economic sphere. Or there are extra cost terms that need to be factored in, such as the opportunity cost of learning and adapting to new technology.

Simultaneously, another CDM thesis is that a key Filecoin comparative advantage is its sheer size: ~12500 PiB of RBP right now, and that’s due to the CCs that are invested in the network (~95% of the RBP). If that’s a key component to Filecoin’s eventual success in the competitive marketplace, then it should be conserved as long as possible while the demand for deals remains inelastic, i.e. until technological hurdles are resolved through FVM and market acceptance.

On the worldview of that thesis, introducing or mantaining pro-FIL+ incentives could have unintended side effects. By accelerating Filecoin’s insertion into the Competitive arena of storage without having solved the hurdles, Filecoin could lose its comparative advantage while not having the capacity to generate revenue through deal cycles.

CDM would be needed then for ensuring Network stability and security at a moment when it is not yet ready to leap into its final evolutionary state. This is because CCs must be provided with the incentive they need to stay with the network during those difficult times.

This is the essence of the thesis. The validity of it is unknown, as we don’t have accessible objective information about the supply and demand elasticities or projections on those. However, it is a potential catastrophic threat to the Filecoin network, and if the thesis is true, it can be triggered by interfering with the current state of the system. In that sense, postponing or rejecting decisions that interfere with the CCs economic calculus may be a prudent decision to have given the Precautionary Principle and given that we cannot Disprove the thesis as of now.

Also, although both FIP-0036 and CDM favor long-duration CCs, there is a key assumption everywhere: the Average Sector Lifetime will go up proportionally. It is unknown how the current SPs will causally respond to this change, given that there’s a temporal discounting rate involved as per the “The resulting redistribution of Token Wealth towards FIL+” concern.

Meta-Concerns

In this section, we’ll list concerns about the debate observed by the participants, along with our interpretations of the debated issues.

1) Studies that are non-reproducible

A highlight during the debate was the challenge to reproduce the studies that served as a rationale for the proposals, mainly FIP-0056.

For a study to be reproducible, the exact set of scenarios, parameters, and data generation procedures should be described so that someone with a reasonable amount of time and expertise can generate the same underlying metrics that have generated the rationale for the conclusion.

Some aspects of the studies’ methodologies have been described, but not at the level of detail required for reproduction. It is thus not currently possible for someone to rely upon such a reproduction and have no doubts that what they are observing is the same as what is claimed by the authors of the studies’ respective analyses.

In addition, and at the very least, the post-processed data used in the studies’ analyses should be made available, so that someone can create and pass on their own interpretation(s) of the studies.

2) Studies that are not inclusive of the community worldview

A concern that has appeared in the debate is related to the analysis being shared as not being “realistic”, in the sense that they use metrics that are poor proxies for stakeholders’ utilities, or that the data generation procedures require strong assumptions that are not representative of stakeholder worldviews.

For a reference point, a set of best practices for engaging communities as an Engineer Role is described in the Institution of Civil Engineers Community of Practice.

This is certainly linked with the question of reproducibility discussed above — but there is also another aspect, i.e. it may be that the diverging community needs to feel included in the analytic effort itself. They do not feel that their goals and perspectives are being measured or considered when building scenarios.

Of course, there are questions to be asked here. Are their feelings justified? If yes, what could be done about the miscommunication? If not, then how to include them? Also, is the effort to include them worth it? This brings us to the following Meta-Concern.

3) How representative is the public debate, compared to the populations actually affected?

A concern raised in the Forums focuses on the “excessive noise” generated by a specific group representing only one of the multiple groups that make up the Filecoin ecosystem.

In that sense, one group would appear to be more influential than it actually is due to its virtual presence in the discussions, and would make what could be considered a semi-consensual debate more controversial than it actually is.

By amplifying their voice and being heard above the median levels of other groups, they can position themselves to acquire additional persuasive power compared to others. It can be important to look back at FIP-0036 and examine the resulting votes and associated discussions, to ensure that all groups have provided their positions.

Common Misunderstandings

“FIP-0056 is just like FIP-0036”

FIP-0056 doesn’t include the most contentious point and is a gentler adjustment than FIP-0036.

FIP-0036 proposed tuning the Consensus Pledge to be more aggressive than it is now. That was likely the measure with the greatest impact on Filecoin Economics. FIP-0056 does not propose this.

In addition, the QAP reshuffle generated by the SDM is gentler with FIP-0056: the maximum SDM is lower, and spread through a larger time window.

FIP-0056 introduces a Termination Fee Cap which was not present before. As discussed previously, there are some underlying problems that haven’t been adequately addressed. (There is also the introduction of a Slope Transition time, so that Sectors are further encouraged to go beyond the minimum commitment time.)

FIP-0036 proposes an SDM implementation in stages, during which the maximum sector lifetime would increase by six months every four weeks. FIP-0056 changes would be immediate.

On How Filecoin Economics Works

We did notice over the debate some misunderstandings about how minting works. A typical misunderstanding is to use the conclusion “Network Minting will go down” to convince miners that they will earn less, which is not true. Another is to assume that the Baseline Minting is inherently volatile, so that it should not be considered in the future rewards calculation.

This educational gap is not new. For this reason, BlockScience has created an Educational Calculator for Baseline Minting and multiple articles around Baseline Minting.

The conceptual gap regarding Quality Adjusted Power and what it implies was more concerning, however. This is made evident in the discussions that describe FIP-0056 as being “pro-FIL+”. In reality, if all groups increase their sector lifetimes simultaneously (and there’s no obvious reason to think otherwise), then the incentives will stay as they currently are.

Some confusion was also evident regarding collateral requirements. Filecoin is a dynamic system: the Initial Pledge will change as the system evolves. A ramp-up of QAP Power means soon-to-be lowered collateral requirements. Hopefully, those dynamics are to be intuitive with the Consensus Pledge Educational Calculator.

Because of this perception, we’ll be proposing that we should Foster Community Understanding of Filecoin Economics as part of the ecosystem can move forward.

Part 3: How to Move Forward

On The Sector Duration Multiplier

With Engineering Design problems a commonly followed sequence of actions is normally adopted [6]:

- The Solution Space is identified.

- A set of solutions that follow specific constraints is selected.

- A solution with specific parameters is decided.

One source of friction within the FIP-0056 vs CDM debate is that all three of the above activities are pursued simultaneously, often independently of each other and with tight timelines. As such, the resulting debate becomes overly political.

Creating a Consensus on the Solution requires a comprehensive technical analysis with clearly stated Optimization Goals that are agreed upon beforehand by the participants. Doing that is only feasible if the Solution Space is both constrained enough and simplified enough to allow for formal analysis. Even if this is the case, such efforts can be wasted if the Solution Space being explored is a Problem Space for one of the stakeholders.

As such, if FIP-0056 is not approved, then our suggestion is to go back to the above sequence and ask the following questions, as per the Computer-Aided Governance in Action: Steering Complex Systems Using the CAG Map:

What can we measure?

- What measurements can we derive from the System and from the participants? What are the data collection and reliability properties of those?

What can we modulate?

- What are all the forms available to incentivize Sector Duration? Could we use other forms like an exponential function? Or an additive term? Or other mechanisms that are not QAP-based?

- Which one of the forms tends to afford the most adjustability toward stakeholders’ preferences? Which one is uniquely suited to transform the different interests that someone could have into numbers that can be tuned?

What are we trying to drive?

- What should be the set of utility functions that someone could use for tuning that form? How sensitive are they to internal and external factors when compared to each other? How fragile are the optima being selected?

There would need to be a sequence of interrelated decisions to answer these questions. Numerical parameters can only be decided after the form has been decided.

Going back to the present situation, in this sense the CDM Functional Form[1:2] — because it is a superset — tends to be a superior alternative to the FIP-0056 form due to the variety of behaviors that it can encode in the Ashby sense. If we adopt the CDM Comparable one and set the Quality Ceiling to 20x, then for all purposes, it will be completely equivalent to FIP-0056.

And indeed, this could be a direction, albeit imperfect, towards Consensus: adopt the CDM form and decide on the specific parameters later, while making explicit that CDM can — for certain parameter choices — effectively be just like SDM.

On Community Oversight and Participation in FIP Studies

The reproducibility and the direct relevance of the studies were a concern raised by the community. The fact that FIP-0036 was directly associated with FIP-0056 indicates that parts of the community associate a bias with the studies being conducted. This may or may not be justified, but the perception of bias can already be damaging for future technical proposals that require ample consensus and technical agreement.

In that sense, it is imperative that we work toward a solution that allows for gapping that perception. There are multiple ways in which that was dealt with in other contexts. One of them is to include External Stakeholders in the execution of any attached study that’s associated with a FIP. Those would be responsible for making sure that the voice of the community is expressed in the methodology and interpretation of results.

Another way forward is to have multiple independent reviewers (akin to that reviewer responsible for this Review) when a FIP arises. However, this carries a cost — namely, that work ends up being partially duplicated, and parties can run the risk of sounding adversarial. Doing it right the first time, rather than requiring reviewers, will always be more efficient. Even more so when taking into consideration that the Subject Matter Expertise needs large amounts of time in terms of maintenance for keeping its relevance.

On Fostering Community Understanding of Filecoin Economics

Given the non-orthogonality of FIP-0056 and CDM and the fact that they’re more similar than they appear, much misunderstanding could have been avoided if the right concepts had been employed from the beginning.

More Minting is not More Miner Rewards. More QAP is not more Minting. More QAP can be more collateral initially, but it washes out with time. The Endogenous Economy will only be valuable if it can interact with the Exogenous Economy in the long run. The distribution of QAP dictates one’s relative stake in Reward and Collateral simultaneously.

Filecoin is complex. Many concepts can seem confusing, especially when coming from other Blockchains. Macro and Micro get mixed constantly, and they’re contradictory in several dimensions.

There’s no escape from that beyond creating more accessible educational material, such as content that will delight the community by having an intricate system of levers and counter-levers that faithfully represent interactions within the real underlying ecosystem.

Almost nothing related to Filecoin Economics is there due to randomness. The system designers went through a long process of requirements gathering, mechanism selection, and simulation-based parameter optimization. At the same time, they had conversations with SPs, Stakeholders, and Engineers to ensure that the system would be acceptable for all to use. Soft compromises were made in all instances, while hard compromises that would make the system inviable were never made.

That was three years ago. The Network will only continue to evolve if its participants are allowed to keep experimenting and learning. This process can be accelerated if we give the right conceptual tools. Discussions will be more focused, and divergences will be readily summarized in technical or succinct terms that are more amenable for building a collective and concise community understanding of the Protocol and Proposals, and, ultimately, fostering even more Community Participation.

Suggested Content to Mitigate Misunderstanding

In order to foster a Community Understanding of Filecoin Economics, it is important that the ecosystem have content that is accessible and friendly to newcomers that won’t have all the context behind Filecoin. In order for this to happen, several things are required:

- a visual and interactive “map” of Filecoin,

- a set of stylized explorables that have an underlying story, and

- a multitude of examples and case studies.

This should be an integrated effort, that could tie together existing, excellent public materials that are already present to support first-principles understanding. The Starboard Filecoin Dashboard is one of those for retrieving instantaneous economics metrics. Recently, CryptoEconLab has launched their Medium Blog and an Almanac, where they periodically share their insights and their research directions.

Appendix

Footnotes

- A general expression for a mechanism. Usually, it is a mathematical function that has non-specified parameters, like f(x; a,b)=a∗x+b

- The Comparable CDM is a modification over the original CDM proposal that is parameter-comparable with SDM, i.e., SDM is applied between 1.5 years and five years of sector commitment, and the maximum quality adjustment is 2x.

- The Stylized Average Multiplier Assumes that the entire network is a Giant Sector of Lifetime 2yr with the current RBP / FIL+ state.

- The protocol only allows sectors up to 5 years long. Longer would require additional protocol adjustments.

- The average speed is faster than that because of how Effective Network Time is computed. On average, Baseline will be faster than that. We recommend exploring the Baseline Educational Calculator.

- Brian Douglas, Systems Engineering, MATLAB, https://www.youtube.com/playlist?list=PLn8PRpmsu08owzDpgnQr7vo2O-FUQm_fL

This article was written by Danilo Lessa Bernardineli, Michael Zargham and Jamsheed Shorish with feedback and edits from @JeffEmmett, Nick Hirannet, Kelsie Nabben and Jakob Hackel.

About BlockScience

BlockScience® is a complex systems engineering, R&D, and analytics firm. Our goal is to combine academic-grade research with advanced mathematical and computational engineering to design safe and resilient socio-technical systems. We provide engineering, design, and analytics services to a wide range of clients, including for-profit, non-profit, academic, and government organizations, and contribute to open-source research and software development.